Which of the Following Statements Regarding Risk-averse Investors Is True

When adding a randomly chosen new stock to an existing portfolio the higher or more positive the degree of correlation between the new portfolios risk. FREE The best writer.

We have encrypted all our databases.

. In game theory Homo economicus is often modelled through the assumption of perfect rationality. One assignment at a time we will help make your academic journey smoother. The following are some of the ways we employ to ensure customer confidentiality.

Funds offer choice liquidity and convenience but for a fee and for a minimum investment. For example investors who are risk-averse may prefer to deposit their funds in a potentially lower interest rate but more assured bank account rather than depositing into a stock account but may involve the opportunity in losing value risky. We have also been using secure connections EV SSL Our sample essays.

Get All The Features For Free. In case you cannot provide us with more time a 100 refund is guaranteed. They accept investments that are fair games.

The price of a share of an open-end. Risk aversion is the concept that people prefer to gamble with certainty and plus with the same expected value. The primary benefit of investing in mutual funds is diversification.

The mutual fund raises money from investors and in return investors receive an equity position in the fund. The term Homo economicus or economic man is the portrayal of humans as agents who are consistently rational and narrowly self-interested and who pursue their subjectively defined ends optimallyIt is a word play on Homo sapiens used in some economic theories and in pedagogy. 15 Commonly referred to as the house money effect in the behavioral finance field.

They only care about the rate of return. We use several writing tools checks to ensure that all documents you receive are free from plagiarism. We offer the lowest prices per page in the industry with an average of 7 per page.

We have servers that operate 999 of the time. Diversification will normally reduce the. They are willing to accept lower returns and high risk.

In case we need more time to master your paper we may contact you regarding the deadline extension. They only accept risky investments that offer risk premiums over the risk-free rate. Our editors carefully review all quotations in the text.

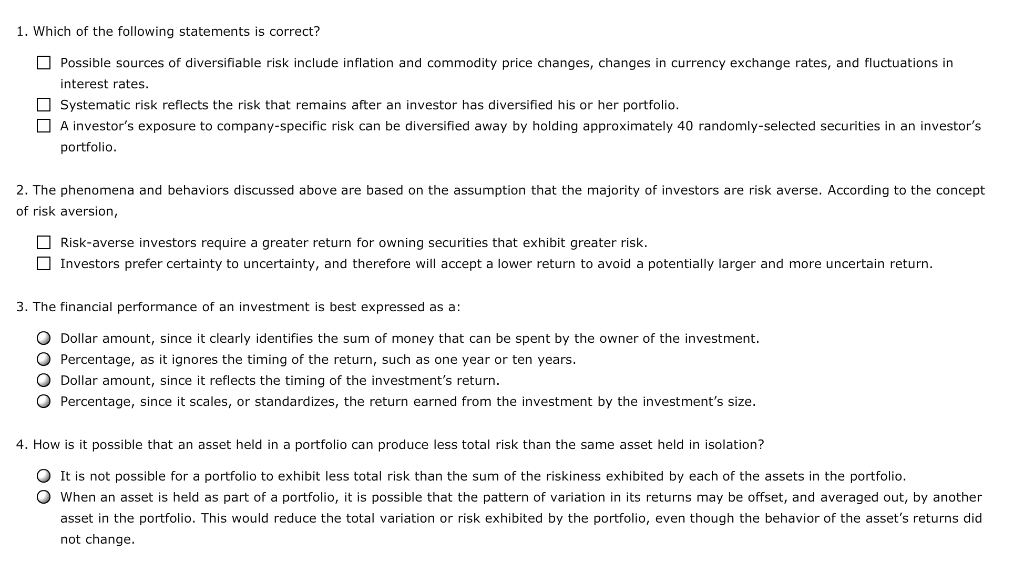

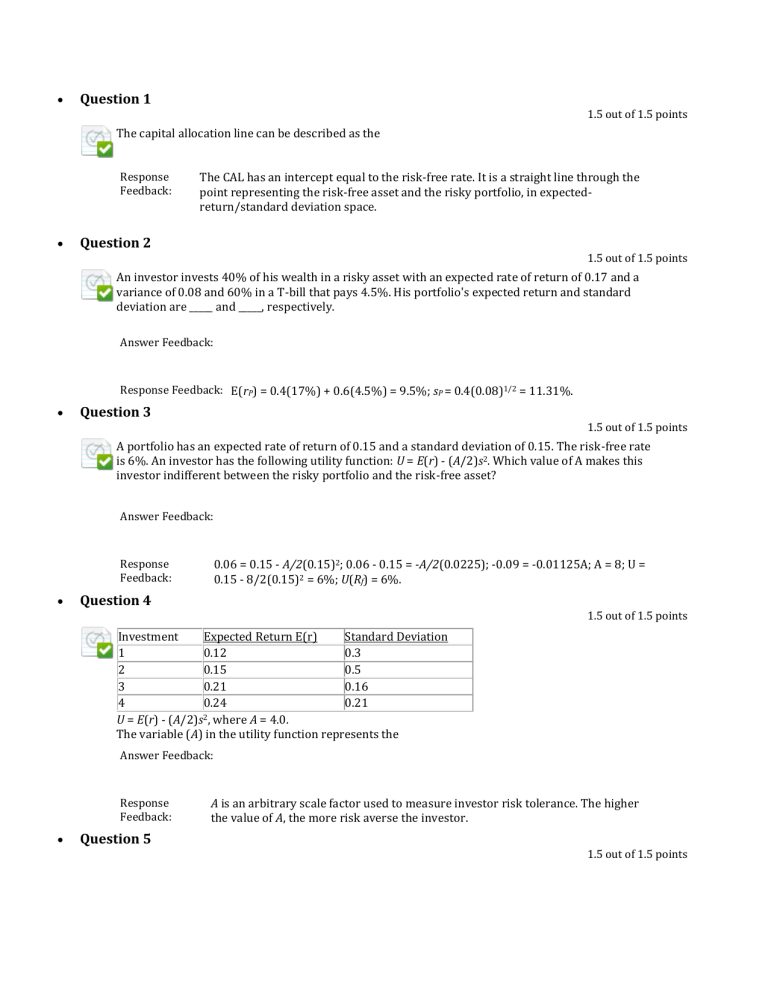

Risk-averse investors require higher rates of return on investments whose returns are highly uncertain and most investors are risk averse. Communicate directly with your writer anytime regarding assignment details edit requests etc. Utility function of a risk.

All our clients personal information is stored safely. Prospect theory has also led to the development of a more robust asset pricing model that incorporates loss aversion and the influence of past outcomes. Which of the following statements regarding risk-averse investors is true.

The proceeds from the shareholders are invested in a group of assets. They only care about the rate of return and accept investments that are. 14 Research has shown how investors become more risk-seeking after experiencing gains but risk-averse after realizing losses.

Rent the Runway RENT Shares Down 5 Following Q4 Earnings Outlook BofA Securities Sees Apple AAPL App Store F2Q22 Revenue Growth of 6 Declining 80 YY Tesla TSLA is Undervalued and.

Risk Averse Definition Favoring Lower Returns Over Lower Volatility

Solved 1 Which Of The Following Statements Is Correct Chegg Com

Risk Aversion Of Investors And Portfolio Selection Finance Train

No comments for "Which of the Following Statements Regarding Risk-averse Investors Is True"

Post a Comment